Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Gold is close to the 618 retracement level, and the resistance of European and A

- Gold prices hit five-week highs

- Eurozone bond market is changing abnormally, analysis of short-term trends of sp

- XM Latin American team uses tufting handmade innovation team building to open a

- The gold daily line is under pressure and pulls back, waiting for the 3300 to st

market news

The market is closely watching the October ADP employment data! If it falls short of expectations, it may significantly increase the probability of an interest rate cut.

Wonderful introduction:

One person’s happiness may be fake, but the happiness of a group of people can no longer distinguish between true and false. They squandered their youth to their heart's content, wishing they could burn it all away. Their posture was like a carnival before the end of the world.

Hello everyone, today XM Forex will bring you "[XM Group]: The market is closely watching the October ADP employment data! If it is less than expected, it may significantly increase the probability of interest rate cuts." Hope this helps you! The original content is as follows:

Asian Market Trends

On Tuesday, as internal disagreements within the Federal Reserve raised doubts about the prospect of another interest rate cut this year, the U.S. dollar index continued its rise and broke through the 100 mark, setting a new high in three months. As of now, the U.S. dollar is quoted at 100.11.

According to the New York Times, the Trump administration has formulated a number of military action plans against Venezuela

, including direct strikes against the forces protecting President Maduro and possible actions to seize control of the country's oil fields.

Trump: Republicans will get all bills approved without filibuster.

The US government shutdown continues and the 35-day record is about to be broken.

Russian President Vladimir Putin signed a decree establishing a year-round military conscription system.

A drone was discovered at Brussels Airport and Belgian airspace was closed.

Summary of institutional views

Fanon Credit: With the ECB on hold, the prospects for interest rate fluctuations caused by this condition appear to be low

With inflation broadly at target, financing conditions loose and nominal growth above trend, there is no reason to expect the ECB to change policy in the foreseeable future, barring some major external shock. Since no one can reliably predict unknown events, this means that currency market segments will be very flat, with realized volatility at extremely low levels. for a while,This was more positive for realized volatility at the far end of the curve, but this is no longer the case as the term premium on the dollar curve is correcting downwards and the unrealistic prospect of Dutch pension funds dumping duration assets into the market has been brought under control.

With the ECB on hold, Germany has breached its debt brake rules and France will only slowly reduce its deficit, with prospects for interest rate swings caused by monetary and fiscal policy appearing low. In our view, this makes geopolitics a potential driver of volatility, but don't forget how huge the public sector and its spending has become. As for macro data surprises, for the Eurozone we would need a significant change in the inflation outlook, which would point to another energy shock, which has become less likely. This suggests that volatility will remain low or move lower going forward.

To be clear, volatility markets are almost entirely a by-product of interest rate markets, so it is not surprising that the lack of downside returns in the swap curve is synonymous with lower volatility levels. In the extreme case, assuming ECB policy remains at the current neutral level indefinitely, the downside returns and implied volatility for any slope will collapse to zero. Clearly this is not going to happen, so investors will need to judge empirically how long the current curve dynamics will persist. In our view, selling volatility at the longer end of the curve has more potential, by using shorter maturities to capture time decay, while it also makes sense to sell longer maturities in the money market segment, albeit via receiver options, to profit on both the upside of the curve (in the absence of rate cuts) and the downside of the volatility surface.

Fanon Credit: If this happens, the Fed will be structurally more dovish

Given our internal view that the Fed will stop easing policy in 2026, we expect interest rates to rise slightly. Our macro view on the Fed is more pessimistic than market pricing, which is pricing in nearly 70 basis points of rate cuts in 2026. Indeed, many FOMC members expressed concern about stubbornly high inflation even as the labor market showed signs of weakness. We expect the 2-year yield to trade in the high 3.00% range as we believe the Fed has limited room to cut interest rates. The 10-year Treasury yield should rise further, with our target reaching 4.50% by the end of 2026, as growth in 2026 is likely to be stronger than in 2025. Our economists forecast that GDP growth will average 2.0% annually in 2026, up from 1.7% in 2025, which is consistent with the Federal Reserve's September 2025 Summary of Economic Forecasts. In our forecast, the yield curve will be range-bound for much of 2026, with a tendency to flatten in the first half of 2026. The 30-year yield should rise, but gains will be limited and remain below 5.00% due to the impact of pension demand/liability-driven investment flows, supported by $40 billion in net Treasury bond split transactions through September and improving pension funding conditions. About our yieldThe main risk to the flattening view is that future pro-administration board appointments could lead to a structurally more dovish Fed.

We expect swap spreads to widen modestly due to regulatory easing and the end of quantitative tightening. The Federal Reserve announced the end of quantitative tightening at its meeting on October 29, and the balance sheet reduction will stop on December 1. The Fed will roll over principal payments on all maturing Treasury securities at auction and will reinvest principal payments on all agency mortgage-backed securities in Treasury securities through secondary market purchases. Quantitative tightening ended earlier than expected due to tightness in the repo market. While the Fed will eventually need to resume reserve management purchases, the exact size and duration have yet to be decided. In addition to QT ending support for front-end rates and the repo market, long-dated Treasuries have also benefited from expected regulatory easing and a less pessimistic fiscal outlook.

Analyst Zain Vawda: Tonight's ADP data may be another "small data" that leads to a "big market"

International spot gold fell sharply in the US market. Although it tested the $4,000 mark in the European market yesterday, it failed to break through because the upward momentum was exhausted. The renewed strength of the U.S. dollar, and its accelerated rise following a hawkish reassessment of expectations for the Federal Reserve's monetary policy, is an important reason for the pressure on precious metals. After last week's Fed meeting, officials made it clear they were unlikely to cut interest rates anytime soon. Market confidence in a rate cut in December this year quickly dropped from 94% to about 70%. The expectation that interest rates will remain high for longer makes gold, which pays no interest, more expensive to hold than interest-bearing dollars, pushing gold prices lower. Key Fed leaders also confirmed that view; some said inflation remains too high and they were prepared to raise rates if necessary, while another expressed concern about cutting rates too early. These signals strengthen the U.S. dollar, hurting gold. The U.S. dollar index has climbed strongly above 100 points, which will be a major signal that the U.S. dollar continues to be strong and will lead to a sharp decline in precious metal prices.

In addition, recent www.xmaccount.comments from the Federal Reserve indicate that its future policies will be more dependent on data. Given that the ongoing U.S. government shutdown is disrupting the normal release of economic reports, that means we have less information than usual. Due to limited data, the few reports that are still released, especially tonight's ADP employment report, may have a much larger impact on the market than usual. The lack of overall data may also lead to a lack of clear direction in currency trading for some time.

Goldman Sachs: The rebound in U.S. bond yields will not last, but making direction decisions will have to wait...

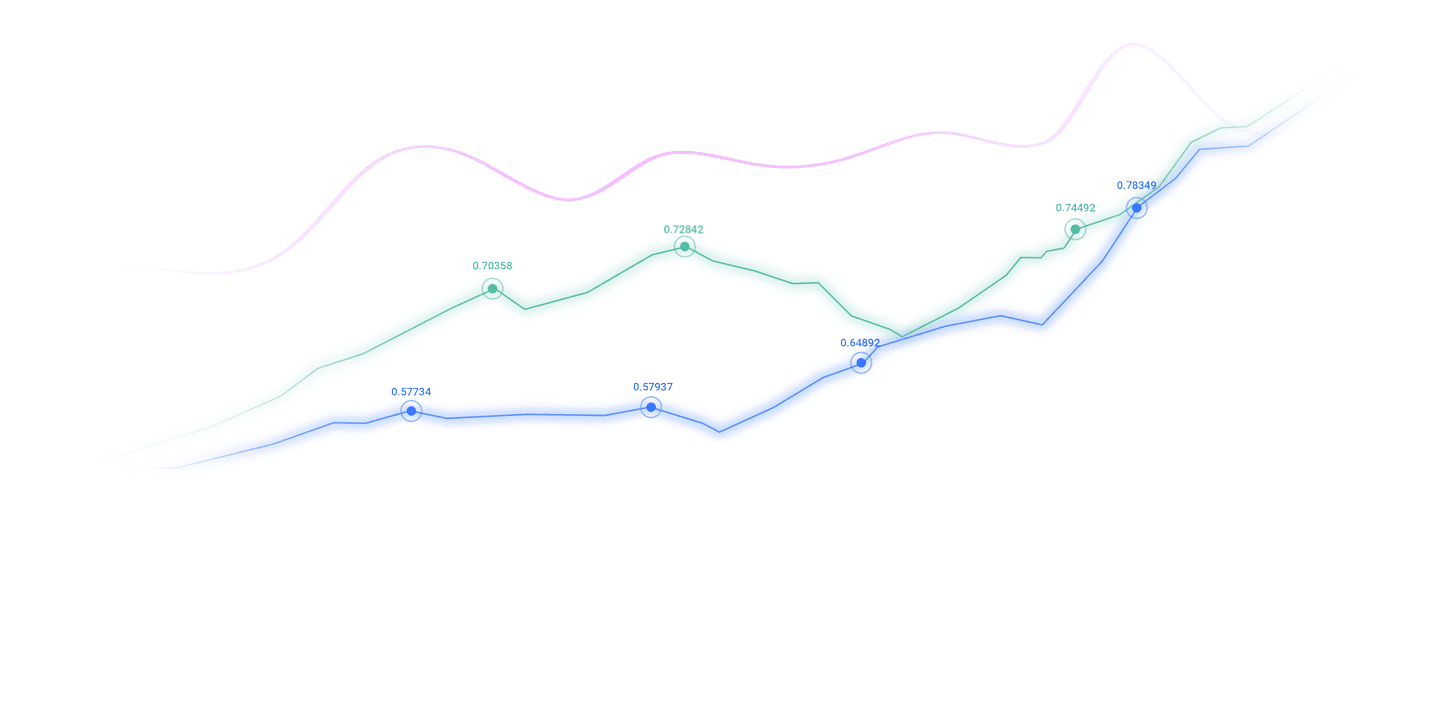

In the past two months, the market has switched between the "Goldilocks" and "Fed put option" states. As market expectations for the Fed's monetary policy to turn dovish continue to rise, the second core driving force in our model representing the stance of monetary policy was pushed to the peak since 2023 before the Fed meeting. In recent days, as markets have begun to trade the logic of reflation, the third factor representing global growth prospects hasOne core driving force has rebounded significantly; at the same time, although the Federal Reserve cut interest rates by 25 basis points, it took a hawkish stance, causing U.S. bonds to be sold off by the market.

The market currently believes that the Fed is most likely to cut interest rates 1-4 times in the next twelve months. This probability has increased since September, but the probability of more than 5 rate cuts has declined. Even during dovish periods such as April and this month on credit concerns, markets have limited pricing for recessionary sharp rate cuts. Our economists still expect another rate cut in December is likely.

The European Central Bank’s decision to hold on unchanged last week was in line with our expectations, and we believe it will continue to maintain a cautious attitude. The Bank of Japan also decided to keep its policy interest rate unchanged, and its future interest rate hike is expected to be at its January 2026 meeting. For the Bank of England, we expect a 25 basis point rate cut, followed by three more cuts in 2026. Market pricing reflects that there may be 1-4 interest rate cuts in the next 12 months, but the probability of deep interest rate cuts is low. Our rates team expects the UK Budget to drive down 10-year Treasury yields, lowering its year-end forecast to 4.0%.

Most assets have benefited from dovish repricing recently. Developed and emerging market fixed income, tighter credit spreads, small-cap stocks (such as Russell 2000) and bond alternatives all performed well. We maintain a moderate risk appetite and recommend taking advantage of the fall in cross-asset volatility to arrange year-end hedging. The reduced probability of extreme policy outcomes has brought interest rate volatility close to the level at the beginning of 2022, and the cost-effectiveness of European interest rate volatility hedging is particularly outstanding.

However, our baseline forecast scenario is that U.S. bond yields will only rise moderately. The interest rate team has always believed that U.S. bond yields will remain volatile at low levels this year, and the direction will be clear after the government shutdown ends.

JPMorgan Chase: Three reasons why the Federal Reserve will cut interest rates in December

Our previous forecast that global central banks will continue to relax monetary policy until the first half of 2026 was mainly based on concerns about a slowdown in global economic growth, rather than expectations that inflation will fall. However, in the past two quarters, global GDP growth has exceeded potential levels - which is contrary to the market's prediction of a mild slowdown in the middle of the year - which makes people question: Are the current easing expectations ahead of reality?

For now, inflationary pressure has not dissipated, with the global core inflation rate continuing to hover around 3%. Inflation levels in major economies are expected to be higher than their central bank/Federal Reserve targets for the fifth consecutive year. In recent quarters, we believe that the Fed's response mechanism has been asymmetrical. While it continues to regard inflation as a "temporary" factor, it is highly sensitive to data indicating a weakening labor market. But with economic growth exceeding potential levels and inflation continuing to be above target, the case for further easing policy is becoming difficult to justify.

The possibility of the Federal Reserve cutting interest rates in December exists but has not yet been determined. Chairman Powell has clearly warned against making simple analogies to the current easing cycle, stressing that a rate cut in December is "far from" a fait accompli. However, we still think the Fed will cut interest rates further in December, reasons include: labor market weakness, Powell's dovish interpretation of recent inflation data, and data uncertainty supporting a conservative policy stance. However, we have also noticed that the recent improvement in the US financial environment, coupled with the latest growth and inflation trends, have challenged the www.xmaccount.common view that the Fed's policy stance is tight.

The above content is all about "[XM Group]: The market is closely watching the October ADP employment data! If it falls short of expectations or significantly increases the probability of an interest rate cut", it is carefully www.xmaccount.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not even qualified to fail, but are born to be conquered. Hurry up and study the next content!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here