Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Trump and Powell's dispute escalates, the dollar is difficult to rise

- Trump waved a 35% heavy hammer to Canada, and the Canadian dollar hit a new low

- The U.S.-European trade prospects suppress gold prices, and the impact of the U.

- The US dollar index is expected to rise, and the Federal Reserve decided to work

- Gold is now priced at 3372 in the morning!

market news

Katayama Satsuki chose to take action when the U.S. dollar crossed the border! The perfect calculation and unspoken worries behind the 100-yen riot

Wonderful introduction:

One person’s happiness may be fake, but the happiness of a group of people can no longer distinguish between true and false. They squandered their youth to their heart's content, wishing they could burn it all away. Their posture was like a carnival before the end of the world.

Hello everyone, today XM Forex will bring you "[XM Forex]: Katayama Satsuki chose to take action when the US dollar was crossing the border! The perfect calculation and unspoken worries behind the 100-point yen riot." Hope this helps you! The original content is as follows:

On Tuesday (November 4) during the Asia-Europe period, the U.S. dollar against the yen once hit a nine-month high of 154.47. When it broke through 150, it received another verbal warning from Satsuki Yamayama, a Japanese financial photographer, and the crowded short-selling Japanese yen trade instantly turned around.

The U.S. dollar has plummeted nearly 100 points against the yen and is currently trading at 153.46 (-0.48%) before rising to 0.15%.

It is worth noting that during the same period, the U.S. dollar index went in the opposite direction, rising by 0.2%. That is, after the Japanese yen received a verbal warning, the appreciation rate still reached 100 points after being hedged by the U.S. dollar, which means that the appreciation would have been more violent.

Katayama Satsuki may have a small idea here, that is, to issue a verbal warning at an important node when the U.S. dollar index reaches the 100 mark. The strength of the U.S. dollar index not only hedges the exchange rate fluctuations of the appreciation of the yen. If the U.S. dollar index is affected by the appreciation of the yen and adjusts from the high of 100 to trigger a technical follow-up sell-off, the extent of the appreciation of the yen will be amplified and its purpose can be achieved.

Katama Satsuki issued an early warning, and the yen rebounded in the short term

Japanese Finance Minister Katayama Satsuki has recently released signals on the fluctuations of the yen against the US dollar exchange rate. He clearly stated that he "noted that the foreign exchange market is experiencing unilateral and rapid fluctuations" and emphasized that he will "continue to evaluate the development of the situation with a high sense of urgency."

Previously, the yen exchange rate against the U.S. dollar had fallen to its lowest level since February, once approaching 154.50 yen per U.S. dollar. After Katayama Satsuki’s speech, the yen exchange rate received short-term support and rebounded to 153.81 yen per U.S. dollar.

The recent intensification of the yen’s volatility and the impact of the Bank of Japan’s policy

PreviewShan Gaoyue revealed that it had issued a strong warning last Friday. The core reason was that the foreign exchange market fluctuated extremely violently in the previous two days. Data show that as of last Thursday, the yen's exchange rate against the U.S. dollar had fallen by nearly 3 yen.

Coincidentally, last Thursday the Bank of Japan announced that it would keep interest rates unchanged at the current level. Although Bank of Japan Governor Kazuo Ueda hinted at a press conference after the policy decision that "an interest rate hike is imminent," the market did not accept this signal, and the Japanese yen exchange rate continued to be under pressure and weakened.

Although the Bank of Japan voted 7 to 2 to continue to maintain short-term interest rates at 0.5%, members Takada Hajime and Tamura Naoki voted against and advocated raising interest rates.

Takada Hajime believes that Japan has "escaped from the normal state of deflation" and has basically achieved the goal of price stability.

Naoki Tamura pointed out that "risks of upward price increases" are increasing and monetary policy should be closer to a neutral level.

The yen continues to be under pressure due to the superposition of multiple factors

In addition to the Bank of Japan’s policy and market reaction, the yen is also facing pressure from other levels.

On the one hand, last week's remarks by Federal Reserve Chairman Powell were more hawkish than market expectations, and the difference in expectations for U.S. and Japanese monetary policies put pressure on the yen; on the other hand, investors generally believe that Japan's new Prime Minister Sanae Takaichi "does not want to see interest rates rise too quickly," and this expectation further weakens the support for the yen.

Institutions said that short-term trigger conditions were not met, which may cost traders

Before the rapid decline of the US dollar against the yen, market participants had generally realized that the risk of the Japanese government intervening in the exchange rate was rising, but most views believed that "the possibility of short-term actual intervention is low."

It is reported that the last time Japan intervened in the foreign exchange market was in July last year, when the U.S. dollar-yen exchange rate was about 160.

From an institutional point of view, the latest research reports from Goldman Sachs and Bank of America both pointed out that the current "immediate risk" of yen intervention is low - even if the yen touches the key 155 yen level to the dollar that traders are concerned about, the triggering conditions for conventional intervention have not yet been met.

Goldman Sachs further predicts that if the US dollar against the yen hits the 161-162 range, the risk of intervention will increase significantly; Bank of America believes that the exchange rate may first test 1 US dollar against 158 yen, and a breakthrough may trigger a policy-level response, and mentioned that the Japanese Ministry of Finance has intervened multiple times in the 157.99 to 161.76 range in 2024.

This kind of consistent expectation means that when the market style changes, it often ends with a sharp rise and a plunge. Affected by the sub-consistent expectation, the Japanese yen's wave of reversal is very rapid, which may cause traders to suffer huge losses.

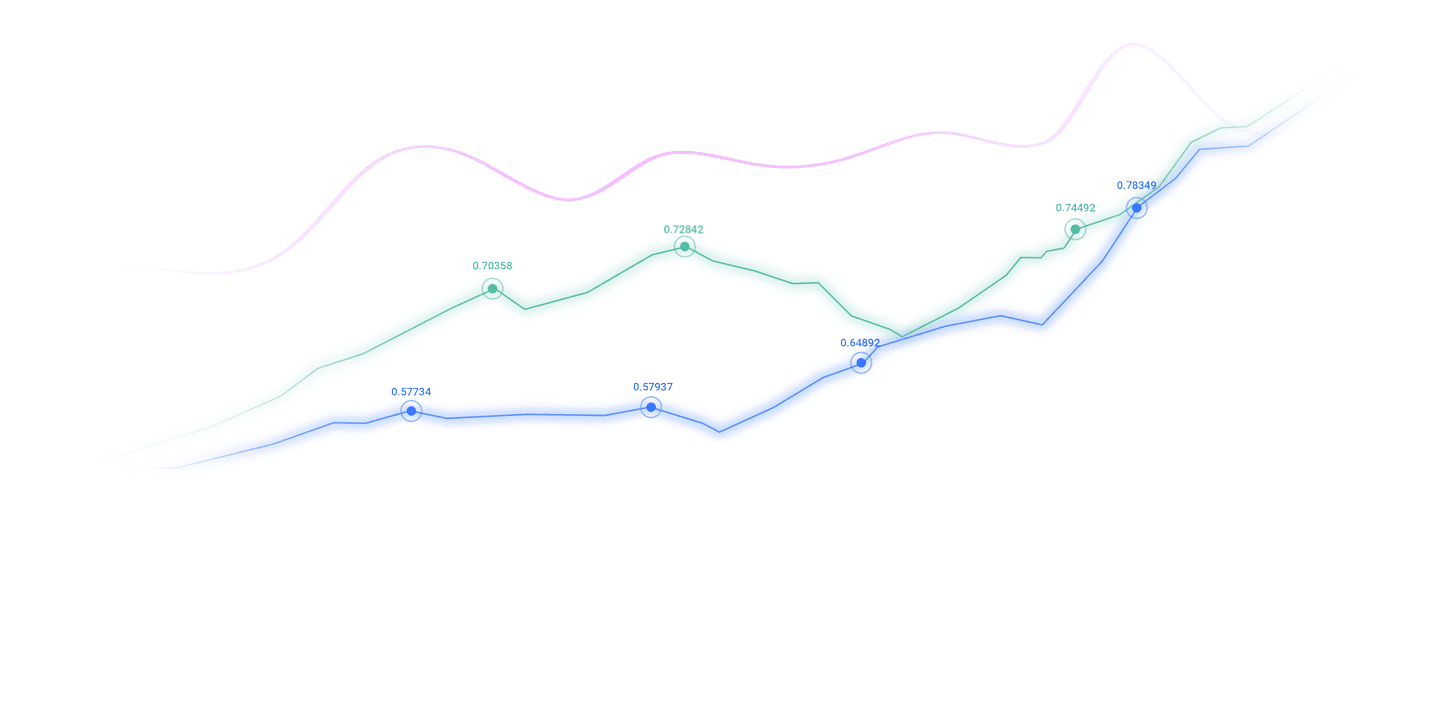

Technical analysis:

The US dollar against the yen stood firm for three days after breaking through the upward trend line. According to traditional technical analysis, the exchange rate should stretch rapidly here, but in actual encounter with verbal warnings, the exchange rate directly turned into a false breakthrough, that is, the breakthrough is the highest point. The breakthrough represents the joint force of the rise and represents crowded trading. Instantaneous changes often lead to rapid adjustments.

At the same time, the U.S. dollar index is crossing the threshold, the euro and others have followed suit, and the Japanese yen has suddenly emerged.

The current support level is around 153.30, followed by the 153.00 integer mark, and the pressure level is 154.50.

At 21:43 Beijing time, the US dollar against the yen was currently at 153.38/39, and the US dollar index was currently at 100.02.

The above content is all about "[XM Foreign Exchange]: Katayama Satsuki chose to take action when the US dollar was crossing the border! The perfect calculation and unspoken worries behind the 100-point yen riot". It was carefully www.xmaccount.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not even qualified to fail, but are born to be conquered. Hurry up and study the next content!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here