Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Practical foreign exchange strategy on August 12

- "Badministrative" will be gone? The US dollar index rebounded slightly, and the

- The US dollar index rises, the market is waiting for US PCE data

- 7.24 Gold surges and falls and turns symmetrical long and short profits, and the

- Chinese live lecture today's preview

market news

The US dollar stands at the 100 mark, Australian dollar bulls: I can hear my heart breaking

Wonderful introduction:

Life is full of dangers and traps, but I will never be afraid anymore. I will remember it forever. Be a strong person. Let "Strength" set sail for me and accompany me to the other side of life forever.

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Market Analysis]: The US dollar stands at the 100 mark, Australian dollar bulls: I can hear my heart breaking." Hope this helps you! The original content is as follows:

During the European session on Tuesday (November 4), the Australian dollar against the US dollar fell back to the 10-day low and traded sideways at 0.6500, reaching an intraday low of 0.6491. The exchange rate fell nearly 0.6% from the previous closing, showing a weak trend in the short term. Traders focused on the latest policy statement of the Reserve Bank of Australia and the repricing of the trend by subsequent data this week.

Fundamentals: The Reserve Bank of Australia remains on hold and the tug of war with stubborn inflation

The Reserve Bank of Australia kept the cash rate unchanged at 3.6%, in line with previous market expectations. Inflation stickiness remains the core constraint on policy direction: data from the Bureau of Statistics showed that the CPI accelerated to 1.3% in the third quarter from the previous quarter, higher than the expected 1.1% and the previous value of 0.7%. This means that price momentum is still above the tolerance range, and policymakers are becoming more cautious in the trade-off between "controlling inflation" and "stabilizing growth." After the meeting, RBA Chairman Michelle Bullock emphasized that core inflation above 3% is "not ideal" and that "a little tightening is needed to cool down the economy and bring inflation back." She did not give forward guidance on when or how much to cut interest rates, citing "there is still great uncertainty about inflation." This statement is more cautious. It does not clearly turn to easing, nor does it rule out the possibility of tightening again when the fall in inflation is hindered. It belongs to a typical "data-dependent" framework.

For the Australian dollar, the www.xmaccount.combination of unchanged policy and "hawkish patience" usually has two-sided effects: First, if the stickiness of inflation continues, the RBA's tight period may be extended, which will be a neutral-to-long marginal support for the Australian dollar's interest rate spreads and carry trades; second, if growth shows weakness again or inflation falls faster than expected, the market will trade in advance the discount path of future easing, putting pressure on the Australian dollar. In the short term, we still need to wait for the September trade balance to be released this Thursday, which is a positive week.Provide incremental information on future www.xmaccount.commodities and external demand clues.

On the other hand, the U.S. dollar remains strong. The market has cooled down on bets on further interest rate cuts by the Federal Reserve this year, and the U.S. dollar index hit a three-month high, breaking through the 100.00 mark. The implied probability from federal funds rate futures shows that the probability of a 25 basis point rate cut to 3.50%-3.75% at the December meeting fell to 67.3% from 94.4% a week ago. When the path of "fewer interest rate cuts, later cuts" was re-priced, the US dollar received widespread buying, and the Australian dollar fell under pressure against the US dollar. The broad-spectrum impact on risky assets will also be transmitted to the foreign exchange market through changes in interest rate terminal prices and term premiums, strengthening the short-term dominance of the US dollar.

To sum up, the signal currently given by the fundamentals is: the Reserve Bank of Australia's "cautious hawkishness" is not enough to offset the periodic strength of the US dollar. Add to this the wait-and-see before the data, the rebound of the Australian dollar lacks sustainability, and the direction is easily pulled by external US dollar factors.

Technical aspect:

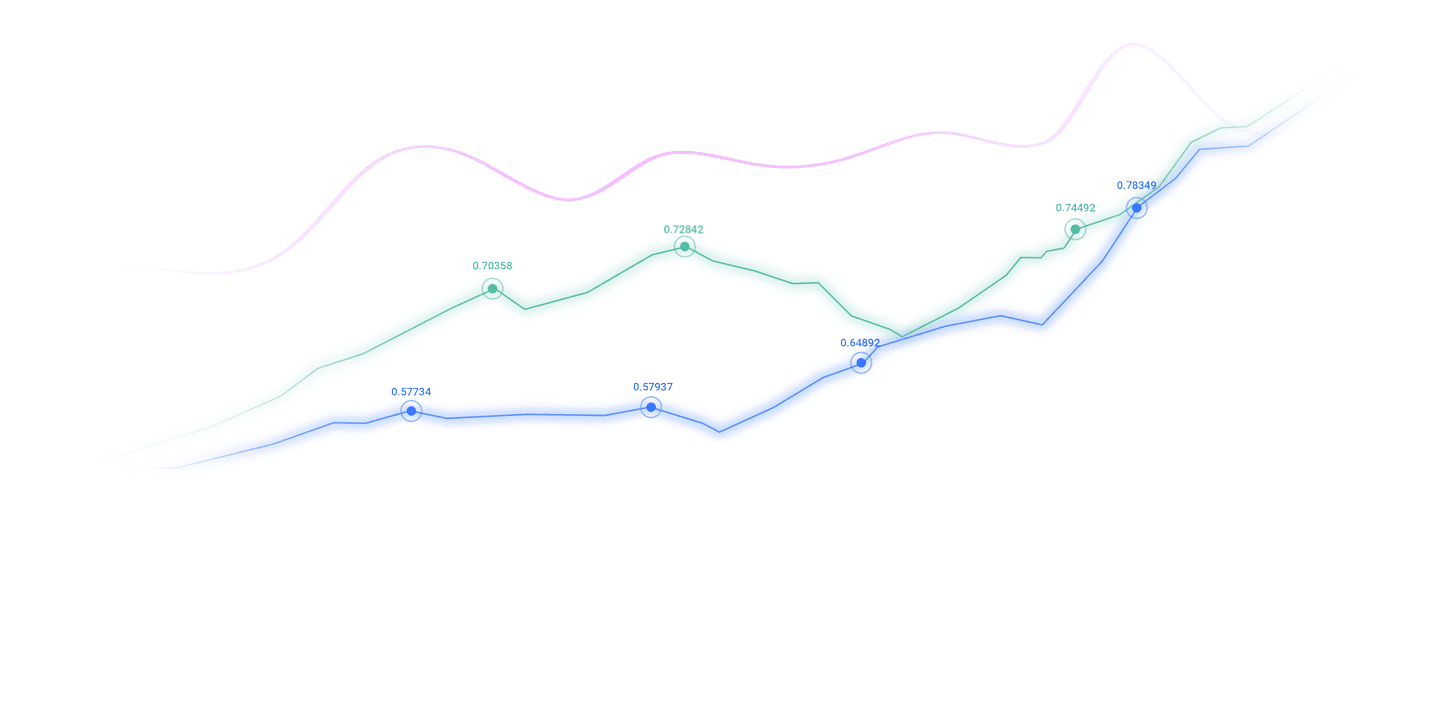

The 30-minute K-line shows that after falling back from the first-line high of 0.6562, the exchange rate fluctuated downward along the short-term downward channel, reaching as low as 0.6491. The 0.6500 integer mark constitutes an immediate psychological level, but the retracement high of 0.6517 above has been transformed into short-term resistance. If it cannot stand firmly above it, the rebound will mostly be a technical repair.

In terms of MACD (26, 12, 9), DIFF and DEA are both below the zero axis and have not formed a golden cross. The histogram is still negative, indicating that although the downward momentum has slowed down in stages, the trend has not yet reversed. RSI (14) is hovering around 35, which is in a weak range but has not entered extreme oversold, indicating that short-term pressure is still mainly on rallies, and the probability of choosing a direction after a technical pullback is higher. Structurally, 0.6491 is the first support. If it falls below, shorts may point to the lower edge band near 0.6480; on the upside, 0.6517 is the first resistance, and further resistance looks to 0.6533 and 0.6562. Only by effectively recovering 0.6517 and breaking through with heavy volume can a backtest of the 0.6533-0.6562 range be triggered, otherwise the probability of the weak shock continuing will be greater.

Market sentiment observation: "cautious defense" led by the strong US dollar

Judging from the synchronization between the market and the news, market sentiment is currently closer to "cautious defense". On the one hand, the Reserve Bank of Australia has not released a clear signal of easing, and short sellers lack sustained drive based on a sharp shift in policy; on the other hand, the US dollar has continued buying within the general framework of "reducing interest rate expectations", and risk appetite and carry trades have been under short-term pressure. If the follow-up data this week fails to change the dominant logic of the US dollar, the short market sentiment will become more sticky; on the contrary, if the trade balance is better than expected and the US dollar falls from its periodic high, it will easily trigger a technical rebound and short covering of the Australian dollar. The turning point of sentiment still depends on the directional consistency of "policy path × data surprise" rather than a single marginal news.

Outlook: Path bifurcation and the game of key positions

Short-term scenario (1-3 days)

If 0.6517 is never effectively recovered and the US dollar remains near a three-month high, the Australian dollar against the US dollar is likely to fluctuate weakly in the range of 0.6491-0.6517, and the risk of repeated testing of the lower edge of the range increases. Once it falls below 0.6491 and forms a heavy-volume expansion, shorts may open a downward inertia window, and then focus on the secondary support around 0.6480 and the emotional defense line of the integer mark. The driver of this scenario is the resonance of "strong US dollar + unreversed technical aspects".

Short-term rebound scenario

If the exchange rate regains its foothold at 0.6517 and the MACD histogram further converges, the rebound will first point to 0.6533 and then challenge 0.6562. This is the overlap area between the previous high and the upper edge of the channel, which belongs to the "strong resistance + intensive supply" zone. Unless it cooperates with the decline of the US dollar and the improvement of interest rate expectations, it will be more difficult to break through and stand firm at once. The core of this scenario lies in the www.xmaccount.combination of "phased retracement of the US dollar + strong Australian data".

The above content is all about "[XM Foreign Exchange Market Analysis]: The US dollar stands at the 100 mark, the Australian dollar is bullish: I can hear my heart breaking". It is carefully www.xmaccount.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Sharing is as simple as a gust of wind can bring refreshing, as pure as a flower can bring fragrance. Gradually my dusty heart opened up, and I understood that sharing is actually as simple as the technology.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here