Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- Gold has a deep V reversal, and the current price in the morning is 3342 and it

- Powell's remarks ignited the market, analysis of short-term trends of spot gold,

- Gold three yin turns to yang cycle, look at the rebound and rise first above 332

- Range oscillation will be maintained before CPI data is released

- Golden Retriever is looking forward to lower interest rates, gold and silver ham

market news

The golden daily line became counter-pressure on the 5th and needs to continue to be sorted out

Wonderful introduction:

The moon waxes and wanes, people have joys and sorrows, life changes, and the year has four seasons. If you survive the long night, you can see the dawn, if you endure the pain, you can have happiness, if you endure the cold winter, you no longer need to hibernate, and after the cold plums have fallen, you can look forward to the new year.

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Decision Analysis]: The gold daily line became counter-pressure on the 5th, and it must continue to be sorted out." Hope this helps you! The original content is as follows:

Zheng's point of view: Gold's daily line became counter-pressure on the 5th, and it needs to continue to be sorted out

Reviewing yesterday's market trends and emerging technical points:

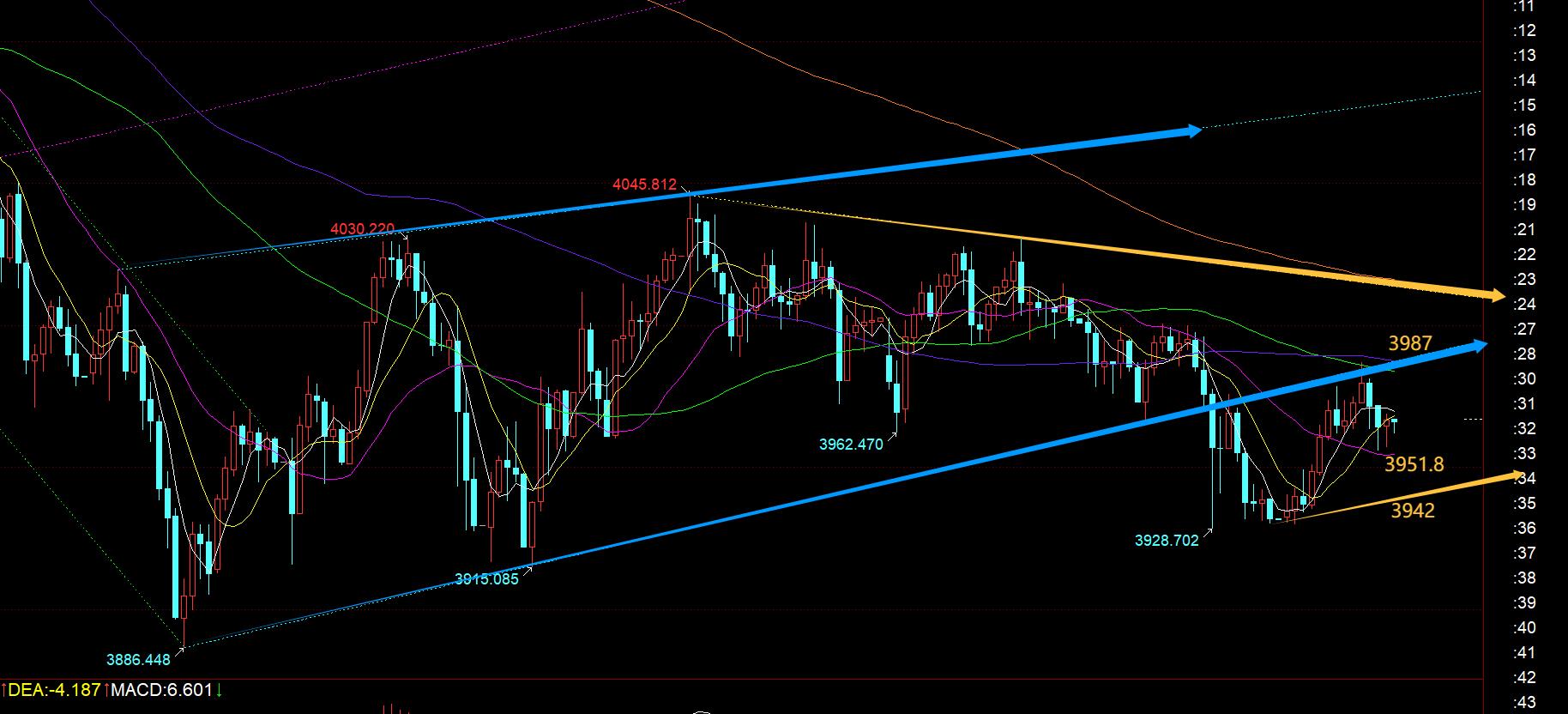

First, gold: Yesterday's Asian market fell in a cycle in the morning, then 3980 stabilized around 11 o'clock to see a rebound. wave, reaching the 4000 target; the European market relied on the convergence triangle lower rail support 3967 to see a rebound and reached the 4000 target again; the US market once again tested the lower rail support 3970, but fell directly below the level, then rebounded below 3975 and followed the bearish trend. Unfortunately, the counterattack speed was fast at that time, and I wanted to observe the closing line more before deciding, so I missed it!

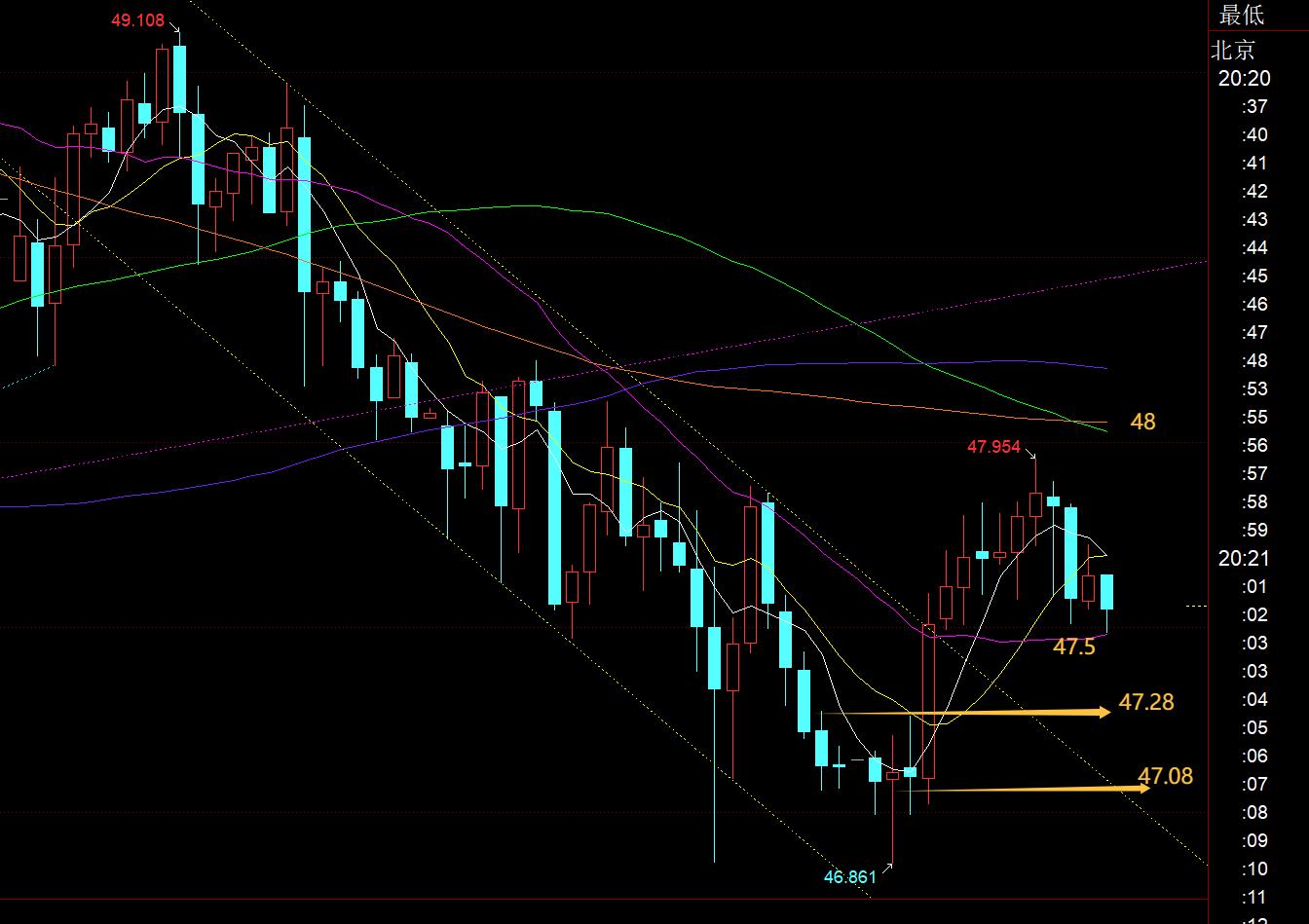

Second, in terms of silver: Yesterday, the Asian and European market fluctuated and slowly went down, and the journey was also very bumpy and highly repetitive. It finally fell to the 46.8 line, close to the weekly 10 moving average support and steadily bottomed out, and then fell back before closing in the middle of the night;

Today’s market analysis and interpretation:

First, the gold daily level: it closed with full Yin K yesterday, effectively falling below the 5 moving average, becoming today’s counter-pressure point at the 3985 line, and the resistance on the 10th moved down to the 4002 line, so the two are the biggest pressures in the short term. Before breaking through, the bottom should remain relatively weak in the range; the weekly 10-day support moved up to 3888, which was also last week's low. At the same time, the 3915 line also supported many times last week, which has important split support. There is also a large support buying for both of them, or Wait for the double bottom to work;

Second, the golden 4-hour level: the mid-rail resistance moves down to 3987, which happens to be the high point at this time of the day, and the annual average support moves up to the 3930 line, and tonight's operating range is probably within this range;

Third, the golden hourly level: The weak trend overnight closed at a low level, but there was no cyclical sharp decline before 8 o'clock this morning. Then, after a shock and rebound, you can rely on the 382 division resistance and the 3950 line to follow the bearish trend first, and then stabilize and pull up when it reaches the 3934 position. , closing at 11 o'clock in Dayang and returning to 3950, means that it will have to go through shocks repeatedly to repair last night's decline; when the European market hits the lower track counter-pressure point of 3985 of the blue convergence channel in the above picture, it happens to be the 66-day moving average pressure point, resonating with the daily line 5-day pressure level, so lurking here in advance to watch the suppression fall, the European market also It was successfully suppressed to close to the mid-track position; there is basically no movement at this time, and the market is quietly waiting for the stimulation of ADP small non-agricultural data tonight. Because this data was suspended last month, this announcement may bring about a lot of fluctuations. It is also a reference for the predecessor of Friday's big non-agricultural data; with the wave of 3930-3987 From a cutting point of view, pay attention to the 618 support 3951.8 below, and the 786 support 3942. The mid-rail position is actually close to 618, and the resistance is 3973, 3987. First, organize around the continued shock between support and resistance, and try to get stuck in the relatively extreme positions on both sides;

Silver: Yesterday, it also closed at YangK, and the short-term 5th and 10th became counter-pressure. Today, the key pressure point is basically at the 48 line; there was a continuous rebound in the Asian market, which basically recovered the drop from the opening of 47.8 overnight; at the same time, as shown in the chart, the yellow downward channel in front has also been broken, so whether this rebound can bring about a good continuation of the rise depends on whether it can hold 47 tonight. 7.28 and 47.08 are supported, and the resistance is 48;

The above are several views of the author's technical analysis. As a reference, it is also a summary of the technical experience accumulated by watching and reviewing the market for more than 12 hours a day for more than 12 years. The technical points will be disclosed every day, with text and video interpretation. Friends who want to learn can www.xmaccount.compare and reference based on the actual trend; those who recognize the idea can refer to the operation Work, be on guard, risk control www.xmaccount.comes first; if you don’t agree, just let it pass; thank you all for your support and attention;

[The article’s opinions are for reference only, investment is risky, you need to be cautious when entering the market, operate rationally, strictly set losses, control positions, risk control first, be responsible for profits and losses]

Writer: Zheng’s Dianyin

Reading and researching the market for more than 12 hours a day, persisting for ten years Detailed technical explanations are open to the public for a long time, and we will serve you with sincerity, sincerity, perseverance and wholeheartedness! Write www.xmaccount.comments on major financial websites! Proficient in K-line rules, channel rules, time rules, moving average rules, segmentation rules, and top-bottom rules; student cooperation registration hotline - WeChat: zdf289984986

The above content is about "[XM Foreign Exchange Decision Analysis]: Golden DayThe line became counter-pressure on the 5th and must continue to be sorted out." The entire content was carefully www.xmaccount.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thank you for your support!

Only the strong know how to fight; the weak are not even qualified to fail, but are born to be conquered. Step up and study the next content!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here