Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- U.S. stocks hit new highs, tech stocks surge mask potential divisions

- 25,000 turns into a key resistance, the Hang Seng Index stops four consecutive i

- The golden step-by-step rises, and we are expected to stand firm tonight and mak

- Empower investors with professional insights and lead the industry's smart upgra

- 7.30 Gold rose first and then fell as scheduled. Today, I wait for the guidance

market analysis

ADP data has pushed the dollar closer to the critical point, and the real game has just begun!

Wonderful introduction:

Only by setting off, can you reach your ideals and destinations, only by hard work can you achieve brilliant success, and only by sowing can you reap the rewards. Only by pursuing can you taste upright people.

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Official Website]: ADP data pushes up the US dollar to approach the critical point, and the real game has just begun!". Hope this helps you! The original content is as follows:

The U.S. ADP employment report released at 21:15 on Wednesday (November 5) showed that 42,000 new jobs were created in the private sector in October, significantly higher than the revised -29,000 jobs last month, and also exceeded market expectations of 37,500 jobs. With the U.S. government shut down for more than 35 days and official employment data delayed, this report has attracted much attention. After the data was released, U.S. stock futures fluctuated slightly, the U.S. dollar and U.S. bond yields rose simultaneously, and gold came under short-term pressure.

Changes in data background and market expectations

This data release is in a www.xmaccount.complex macro environment: the ongoing situation between Russia and Ukraine, pressure on the global supply chain, renewed tariff talk, and the data vacuum caused by the government shutdown, making investors particularly sensitive to employment indicators. ADP data in September once triggered concerns about economic stalling, and the market's expected probability of an interest rate cut by the Federal Reserve in December exceeded 80%. Although October's weekly employment data has shown signs of stabilizing, market expectations are still conservative, with new jobs generally expected to be only between 25,000 and 40,000.

The better-than-expected performance of actual data pushed the market narrative from "recruitment continues to shrink" to "the beginning of a moderate recovery." However, the structural differentiation between industries and the sustainability of wage growth will still be the focus of future attention.

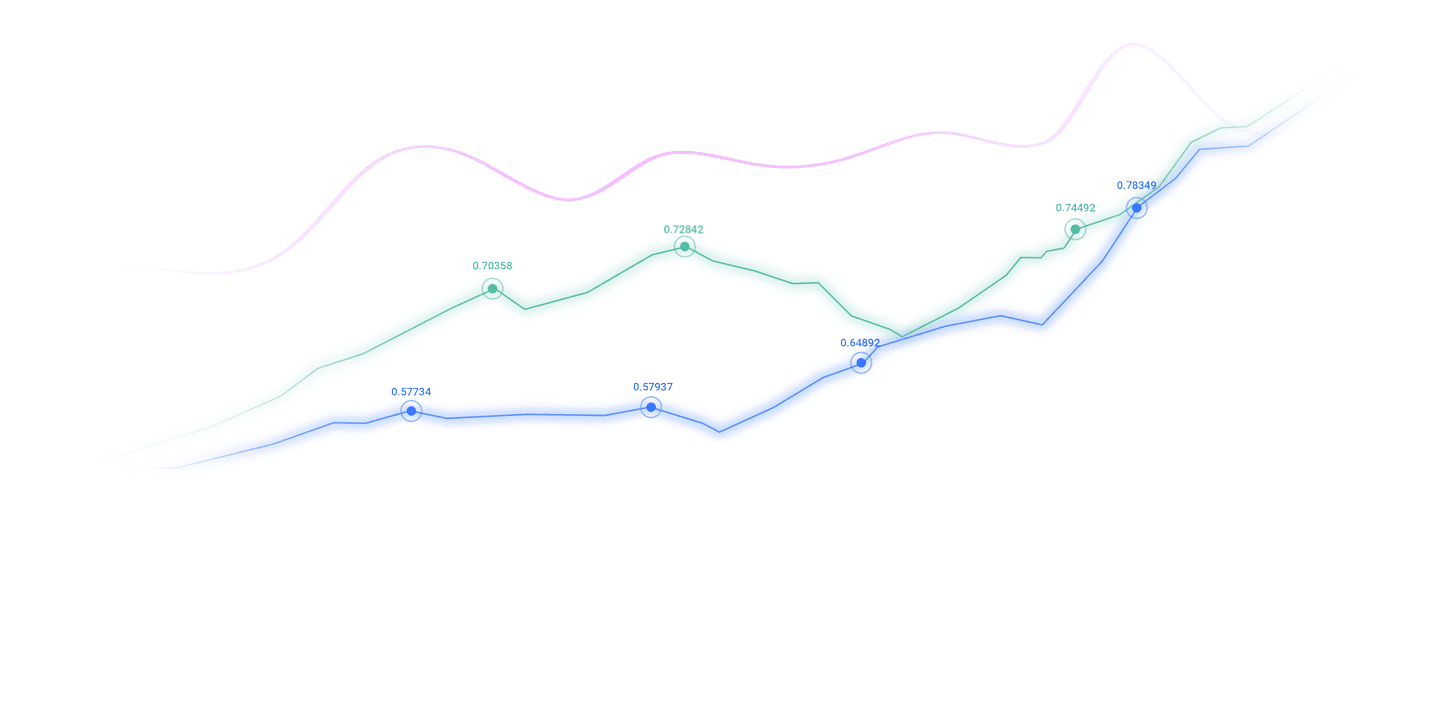

Market reaction: The linkage between the U.S. dollar, gold and U.S. debt

After the data was released, the U.S. dollar index quickly rose 8 basis points from 100.15 to 100.23, turning from a decline to an increase, showing investors' recognition of the resilience of the economy. Spot gold fell from the intraday high of $3,973 to $3,966, with gains narrowing and short-term pressure evident. U.S. bond yields rose simultaneously, with the two-year and ten-year yields rising by 1 basis point each, reflecting the market's concern about inflation.Alertness may rise again.

The pre-market reaction of U.S. stocks was relatively restrained. S&P 500 futures fell slightly by 0.05%. Technology stocks continued to be weak, while the financial and cyclical sectors strengthened slightly. This trend is similar to the market performance when employment data exceeds expectations in the first half of 2025, forming a classic pattern of "strong US dollar, weak gold".

Policy Dilemma under Structural Differentiation

Although ADP data eased recession concerns, it did not change the Fed's easing tone. The report shows that the salary growth rate of retained employees was stable at 4.5%, and the salary increase of job-changers was 6.7%, which shows that the supply and demand of the labor market are becoming balanced and inflationary pressure is limited, but it also restricts the Fed's room for further aggressive interest rate cuts.

From an industry perspective, trade, transportation and public utilities added 47,000 people, becoming the main driving force; financial services rebounded by 11,000, reversing last month's decline. However, manufacturing and professional business services decreased by 3,000 and 15,000 respectively, highlighting the uneven hotness and coldness between industries. If this differentiation continues, it may affect the overall economic momentum through consumption channels, which will in turn affect the Federal Reserve's trade-off between "soft landing" and "structural risks."

Market sentiment: expectations diverge

Before the data was released, market sentiment was cautious. Institutions such as TD Securities predict an increase of 45,000 people, but emphasize that ADP is not a reliable leading indicator of non-farm payroll data. Retail investors are more concerned about seasonal factors and worry that temporary employment during the holidays will cover up the real weakness.

After the data was released, institutions turned neutral and optimistic. MacroMicro pointed out that the 42,000 increase was the highest since July, supporting the strength of the US dollar; mrDIndicators suggested that gold may be under pressure. The reaction of retail investors was more emotional, with some viewing it as a "gold selling pressure signal", while others warned that it might fall back in January after a seasonal rebound. Overall, the discussion shifted from "recession concerns" to "confirmation of moderate recovery", but the difference between institutions focusing on policy impact and retail investors focusing on immediate fluctuations is still obvious.

The resonance of technical and fundamental aspects

The U.S. dollar index is currently quoted at 100.23, close to the recent high. From a technical point of view, the support is located in the 99.80-100.00 range (based on the October low and Fibonacci retracement), while the resistance is in the 100.50 area. Whether it can break through needs to be confirmed by ISM service industry data. If the 10-year U.S. Treasury yield further rises above 3.60%, it may strengthen the upward momentum of the U.S. dollar; conversely, if gold holds steady support at $3,960, it reflects that safe-haven demand is still there.

www.xmaccount.compared with the panic at the low of 99.50 at the end of September, this round of dollar rebound is more orderly, showing that the market is adapting to the Fed's "gradual easing" policy rhythm.

Outlook: Hidden worries amidst resilience

In the short term, the government shutdown has delayed the release of non-agricultural data, and the ISM service industry PMI (expected to be 50.7) will become the next market focus. If its employment sub-indicator continues to be weak, it may reignite expectations of interest rate cuts and push the dollar back to test below the 100 mark.

In the medium to long term, the structural differentiation of the job market still needs to be resolved through policies. Recovery in trade and finance is expected to support consumption, but continued weakness in the manufacturing sector will test the Fed's ability to balance. In the future, investors should focus on the transmission path of wage growth to consumption momentum, as well as the marginal impact of global geopolitics on the supply chain.

Overall, although this ADP data did not change the main line of easing, it provided the market with breathing space. Short-term fluctuations are expected to be within control, and long-term trends still depend on the quality of the recovery in official employment data and policy responses.

The above content is about "[XM Foreign Exchange Official Website]: ADP data pushes up the US dollar to approach the critical point, and the real game has just begun!" It is carefully www.xmaccount.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Live in the present and don’t waste your present life by missing the past or looking forward to the future.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here