Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- A collection of positive and negative news that affects the foreign exchange mar

- 8.6 How to solve the problem of being trapped with a strong rise in gold? The la

- Silver may test the $37.17 support level

- WTI crude oil is showing a bearish trend below the 50-day moving average

- The darkest moment in the euro zone! Markets short the euro, betting on historic

market news

AI bubble, power struggle within the Republican Party escalates, who is betraying Trump? The market has smelled the blood of 2026

Wonderful introduction:

Only by setting off, can you reach your ideals and destinations, only by hard work can you achieve brilliant success, and only by sowing can you reap the rewards. Only by pursuing can you taste upright people.

Hello everyone, today XM Forex will bring you "[XM Forex official website]: AI bubble, power struggle within the Republican Party escalates, who is betraying Trump? The market has smelled the blood of 2026." Hope this helps you! The original content is as follows:

On Wednesday (November 5), the U.S. dollar index remained fluctuating above 100. Yesterday, major short sellers in the U.S. funds revealed their positions and made bearish remarks on U.S. technology stocks. Public opinion fermented and caused the U.S. stock market to plummet. At the same time, coupled with the Republican election defeat, the U.S. dollar received safe-haven buying.

The 2025 non-election year election in the United States is the first major election since Trump took office in January 2025. It is different from the presidential election and mid-term elections. The election covers key positions and issues in many states.

In Virginia, an important swing state, the Democratic candidate defeated the Republican candidate and became the first female governor of the state, leading the Democratic Party to achieve "full control of the three powers" (governor, lieutenant governor, and state attorney general).

At the same time, 34-year-old democratic socialist Zohran Mamdani was elected mayor of New York with 58% of the vote, defeating an independent candidate supported by Trump. The result was regarded as an "early public opinion indicator" of voters' performance of the Trump administration. It had signaling significance for the 2026 mid-term elections and also exposed divisions within the Republican Party.

The core contradiction after the defeat: accusations and alienation within the Republican Party

President Trump deliberately kept a distance from the defeated Republican candidates, while ordinary Republicans fell into a dilemma of blaming each other.

The www.xmaccount.combination of all factors caused Republicans to experience a storm of mutual accusations and accountability on election night. In this election, the Republican Party suffered disastrous defeats in state-level races in Virginia, New Jersey, California and many other states, and the party was eager to find those responsible for the defeat.

Differences in attribution of defeat: Different interpretations of the “cause of defeat” by various parties

Trump will loseLeigh partly attributed it to his not appearing on the ballot. He also posted in all capital letters on the "Truth Social" platform, saying, "Polling agencies show that Trump's failure to appear on the ballot and the government shutdown are the two main reasons for the Republican Party's defeat in tonight's election."

Trump’s core allies blamed the problem on “poor candidate qualifications,” and his aides more directly targeted Virginia gubernatorial candidate Winsome Earl-Sears and New Jersey gubernatorial candidate Jack Ciattarelli.

A Republican and Trump's close ally Vivek Ramaswamy (Ohio gubernatorial candidate) believes that the Republican Party has failed to "effectively deal with the issue of rising costs" and the people have not felt that the campaign promise of "lowering costs and increasing disposable income" has been fulfilled.

Some Republicans tried to downplay the impact on Trump, saying that the defeat was due to "Democratic voters in Democratic-leaning states being more motivated to vote" rather than voters being dissatisfied with Trump, in order to cushion the impact on the 2026 midterm elections.

Real defeat: specific defeat performance of the Republican Party in multi-state elections

The Republican Party's defeat was extremely significant. Key results include: Virginia: Democrats swept all three state-level offices and captured 13 seats in the state House of Representatives;

New Jersey: Democrat Mickey Sherrill defeated Republican Jack Ciattarelli by 13 percentage points, and also Win multiple counties that Trump won in 2024;

Pennsylvania: Three Democratic justices on the state Supreme Court successfully retained their seats;

California: Voters passed Proposition 50, redrawing congressional districts to favor Democrats;

Georgia (leaning Republican): Democrats removed two Republicans in the state Public Service www.xmaccount.commission election.

Key figures speak out: evaluation of the defeat and campaign strategy propositions

Chris Lacivetta (former Trump campaign manager): He believed that Earl Sears' poor performance was "a defeat caused by himself", saying that "bad candidates and inefficient campaigns will inevitably lead to consequences, and the Virginia gubernatorial election is a typical case."

Alex Brousewitz (Trump ally and head of Super PAC): Accused Earl Sears of being "not a Trump ally", urging Republican candidates to "support the president more firmly and fully embrace the concept of 'Make America Great Again'", saying that "electing moderates with ambiguous attitudes toward Trump in swing states will not work."

Mike Hahn (New Jersey Republican strategist): Thinks the loss in New Jersey was Jack Ciattarelli's "own problem" (three losses, always a risk) rather than a poll on Trump.

Andrew Corvitt (spokesperson of the "Turn to America" organization): Advocated that Trump should have given more support to Ciattarelli (who was endorsed by Trump), saying that "Trump's platform can increase the enthusiasm of his supporters to vote."

Focus of controversy: Trump’s campaign participation and “alienation”"Feeling of alienation"

Almost no Republicans criticized Trump for "refusing to participate in election activities in Virginia, New York, and California," implying that running in states with traditional Democratic support may be "counterproductive."

But Trump only held a telephone canvassing event for Republicans the day before the election (Monday), and his "alienation" from the party's core candidates was fully Highlights - especially from Earl Sears, who has criticized him many times, Trump deliberately kept his distance throughout the whole process

Potential impact on the capital market and the US dollar index

The results of this election have had a marginal impact on the short-term capital market and the US dollar index through the transmission of policy uncertainty and market sentiment. In the medium and long term, the politics of the 2026 mid-term elections need to be anchored. Evolution of policy expectations:

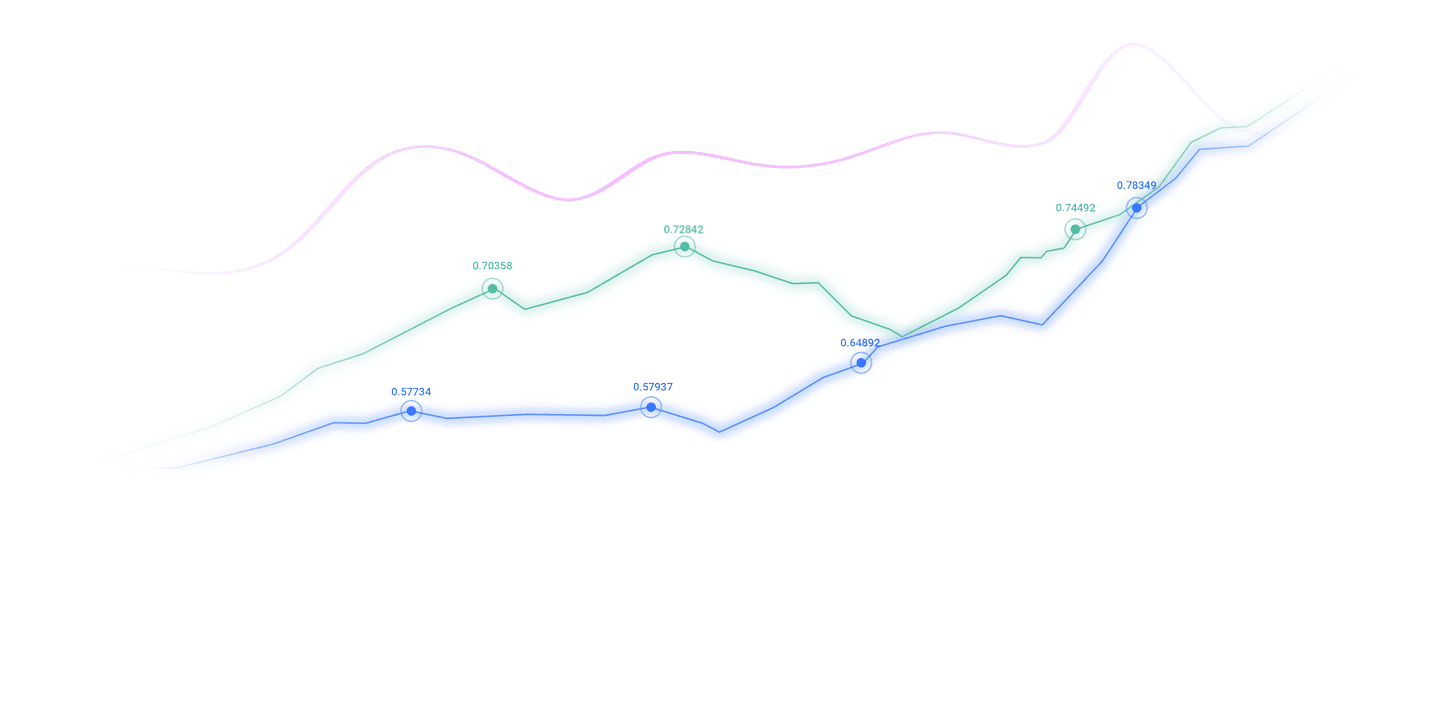

From the perspective of the U.S. dollar index, the short term shows a "shock pattern under the support of risk aversion." The U.S. dollar index is currently trading around 100.20. Affected by the internal differences in the ruling party exposed by the election and the continued impact of the government shutdown, market risk appetite has fallen in stages, and the safe-haven attribute of the U.S. dollar has been moderately supported.

Traders should pay attention to the U.S. dollar and risk sentiment. Linkage - If the internal conflicts within the Republican Party intensify and trigger political risks, the US dollar may rely on its safe-haven attributes to strengthen. At the same time, the market will pay attention to the ADP released at 21:15 tonight. If there is a lower-than-expected development, that is, the number of people decreases too much, it may re-raise the market's expectations for the Federal Reserve to cut interest rates, thereby suppressing the US dollar index.

At the same time, the failure of the Republican Party will strengthen. The expectation of "increased resistance to the implementation of economic policies" - public dissatisfaction with rising costs and intra-party differences on economic issues may weaken the efficiency of subsequent fiscal stimulus or reform plans. The government shutdown has led to the lack of key data such as non-farm employment, which has reduced the Fed's December interest rate cut expectations from 95% to 67.3%. Policy uncertainty has further amplified the fluctuations of the US dollar.

In terms of U.S. stocks, the victory of the Democratic Party in key states triggered an adjustment in expectations for specific sectors: the election of a left-wing candidate in New York City made Wall Street worried about corporate tax increases and tightening of regulations, and technology stocks were under short-term pressure;

In the elections in swing states such as Virginia, "people's livelihood cost issues dominated", pushing defensive sectors such as consumer staples and utilities to gain the favor of safe-haven funds.

In general, this non-election year election is more like a "touchstone of market expectations". The two major signals it revealed, "economic anxiety" and "increased political divisions", have shifted the US dollar and US stocks from "policy certainty trading" to "uncertainty pricing". In the future, we need to focus on the verification of this logic by the December Federal Reserve interest rate decision and inflation data.

Technical aspect:

Affected by public opinion on the AI bubble and the election in the United States, the US dollar received safe-haven buying, and the US dollar index closed above the 100 mark.

If the US dollar index can continue to hold the 100-point mark, the market may think that the US dollar index is in a bullish range, thus attracting bullish buying. MACD and RSI are both bullish, and the current pressure is at 100.4.5. The support is near the 5-day line of 99.88, but looking at the U.S. dollar index from a large level, the rise of the U.S. dollar index is too short, and it still looks like a rebound after a sharp decline.

The above content is all about "[XM Foreign Exchange Official Website]: AI bubble, power struggle within the Republican Party escalates, who is betraying Trump? The market has smelled the blood of 2026". It was carefully www.xmaccount.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Every successful person has a beginning. Only by having the courage to start can you find the way to success. Read the next article now!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here