Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The US dollar has suffered a big defeat! The probability of a 98% interest rate

- U.S. crude oil WTI has been falling for six consecutive times, why is the market

- The RBA removes the mask of "foresight guidance" and the resolution this week ma

- 8.19 Gold fell sharply and crude oil fluctuated and rose latest market trend ana

- Fed meeting minutes show two voter opposes keeping interest rates unchanged

market news

The U.S. dollar index fell below the 100 mark, and the U.S. labor market is full of fog

Wonderful introduction:

Only by setting off, can you reach your ideals and destinations, only by hard work can you achieve brilliant success, and only by sowing can you reap the rewards. Only by pursuing can you taste upright people.

Hello everyone, today XM Forex will bring you "[XM Foreign Exchange Decision Analysis]: The U.S. dollar index fell below the 100 mark, and the U.S. labor market is full of fog." Hope this helps you! The original content is as follows:

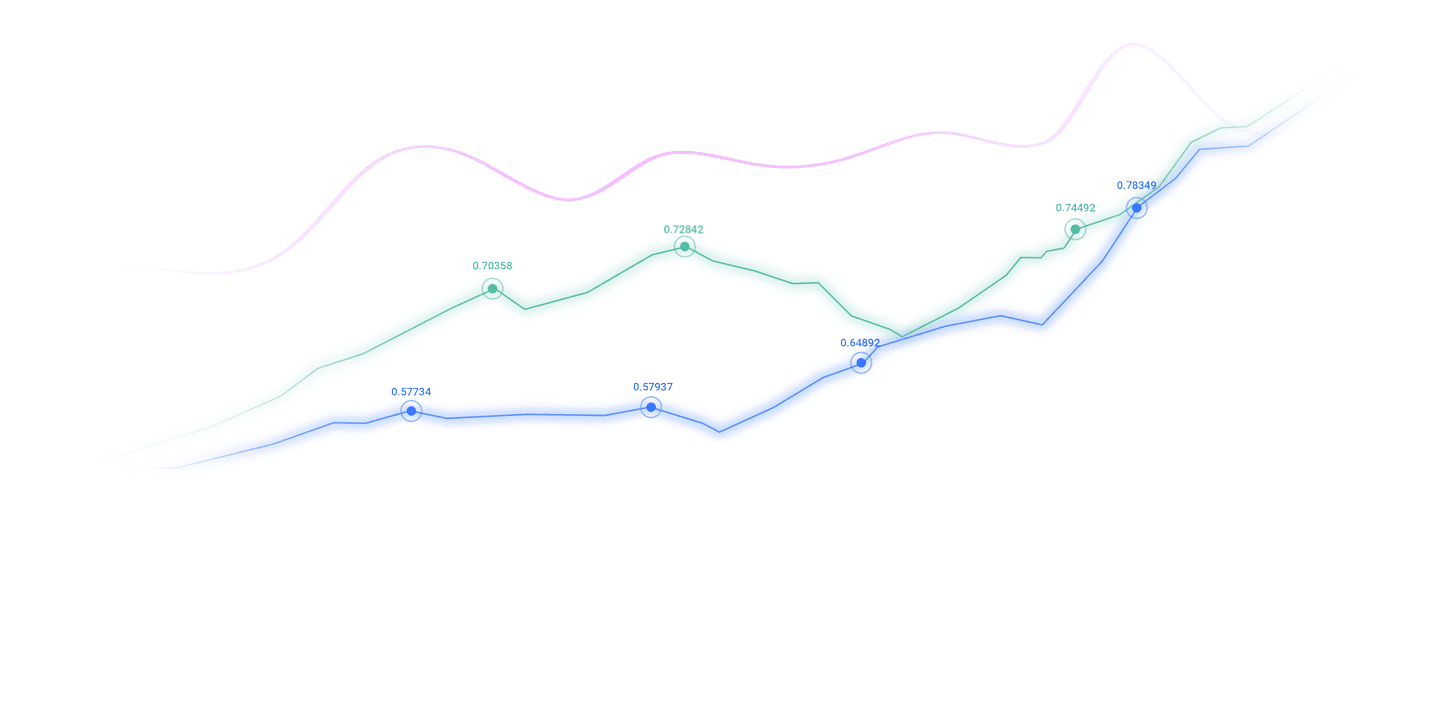

On November 7, in early Asian trading on Friday, Beijing time, the U.S. dollar index was hovering around 99.72. On Thursday, the U.S. dollar index continued to fall during the day, falling below the 100 mark, and expanded its losses during the U.S. trading session, finally closing down 0.45% at 99.67. The benchmark 10-year U.S. Treasury yield finally closed at 4.088%, and the 2-year U.S. Treasury yield, which is sensitive to the Fed's policy rate, closed at 3.570%. Spot gold was on a "roller coaster". It once returned to above US$4,010 during the European trading session. However, before the US trading session, the price of gold plunged sharply, then wiped out all the gains during the day and turned down. It finally closed down 0.05% to close at US$3,977.17 per ounce; spot silver finally closed up 0.03% at US$48.01 per ounce. As the market is still worried about oversupply, crude oil fell for the fourth consecutive day. WTI crude oil once returned to above the $60 mark during the European trading session, but then quickly fell back and accelerated its decline before the US trading session, erasing all gains during the day. It finally closed down 0.13% at US$59.40/barrel; Brent crude oil finally closed down 0.18% at US$63.21/barrel.

Analysis of major currency trends

U.S. dollar index: As of press time, the U.S. dollar is hovering around 99.72. The latest U.S. non-farm payrolls (NFP) numbers will be released on Friday, however the longest government shutdown in U.S. history has limited the flow of official data sets. Even though private data releases tend to produce volatile results between releases, investors still default to paying more attention to private data releases. Results from the University of Michigan Survey of Consumer Sentiment and Consumer Inflation Expectations are still due for release on Friday, and those results could become even more www.xmaccount.complicated for investors who miss out on meaningful government-level inflation and labor indicators.important. Technically, if the U.S. Dollar Index falls below the 50 EMA at 99.54, it will head towards the nearest support, which is located in the 98.85–99.00 range.

Gold and crude oil market trend analysis

1) Gold market trend analysis

In the Asian market on Friday, gold hovered around 3992.36. Gold edged higher amid a weaker dollar and renewed safe-haven demand. Traders awaited preliminary readings from the University of Michigan Consumer Sentiment Survey due later on Friday. Concerns about a prolonged U.S. government shutdown and uncertainty over the legality of tariffs could boost safe-haven flows, supporting gold prices. The U.S. government shutdown has entered its sixth week, and there appears to be no end in sight to the stalemate. The Senate currently does not plan to vote on Thursday on the House-passed measure to reopen the government, after the bill failed to advance for the 14th time on Tuesday.

2) Crude oil market trend analysis

On Friday’s Asian session, crude oil was trading around 59.53. West Texas Intermediate (WTI) crude extended losses for a third straight day on Wednesday, falling below the key $60.00 per barrel mark and hitting a one-week low after the latest report from the U.S. Energy Information Administration (EIA) showed a larger-than-expected build in inventories.

Foreign exchange market trading reminder on November 7, 2025

16:00 Fed Williams delivers a speech

20:00 Fed Vice Chairman Jefferson delivers a speech

2 1:30 Canadian employment number in October

23:00 Initial value of the one-year inflation rate expectation in the United States in November

23:00 Initial value of the University of Michigan consumer confidence index in November in the United States

Next day 00 :00 The New York Fed's 1-year inflation expectations in October in the United States

The next day at 02:00 The total number of oil drilling rigs in the United States for the week to November 7

The next day at 04:00 Fed Governor Milan gave a speech on stable currencies and monetary policy< /p>

The above content is all about "[XM Foreign Exchange Decision Analysis]: The U.S. dollar index fell below the 100 mark, and the U.S. labor market is full of fog." It was carefully www.xmaccount.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Due to the author's limited ability and time constraints, some contents in the article still need to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here