Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The US dollar broke through the 100 mark, and the heavy data tonight is coming!

- Japan's inflation rate fell to 3.1%, hitting a new low in nearly eight months, a

- Chinese live lecture today's preview

- Next week will be a critical period, with economic data and trade negotiations d

- The latest trend analysis of the US dollar index, yen, euro, pound, Australian d

market news

11.5 The latest market trend analysis of gold and crude oil’s shock and decline and today’s exclusive operation suggestions

Wonderful introduction:

Life is full of dangers and traps, but I will never be afraid anymore. I will remember it forever. Be a strong person. Let "Strength" set sail for me and accompany me to the other side of life forever.

Hello everyone, today XM Foreign Exchange will bring you "[XM Foreign Exchange Platform]: The latest market trend analysis of 11.5 gold and crude oil shock and decline and today's exclusive operation suggestions." Hope this helps you! The original content is as follows:

The investment market always has four levels: preserving principal, controlling risks, earning income, and long-term stable and sustained profits. Don't decide the outcome based on one day's winning or losing. Whether making money is accidental or inevitable, whether it is based on hard work or luck. Those who survive in the market must be the investors who can ultimately make sustained profits in the long term. Trading is a good habit and strictly implement your trading plan. A rigorous transaction = good mentality control + correct position control + excellent technical skills. Cooperation never involves forced buying or selling. Opportunities are reserved for those who are prepared. One correct choice is greater than a hundred times the effort. You believe the teacher, I will give you a satisfactory income, you just need it, I am just professional!

Gold's latest market trend analysis:

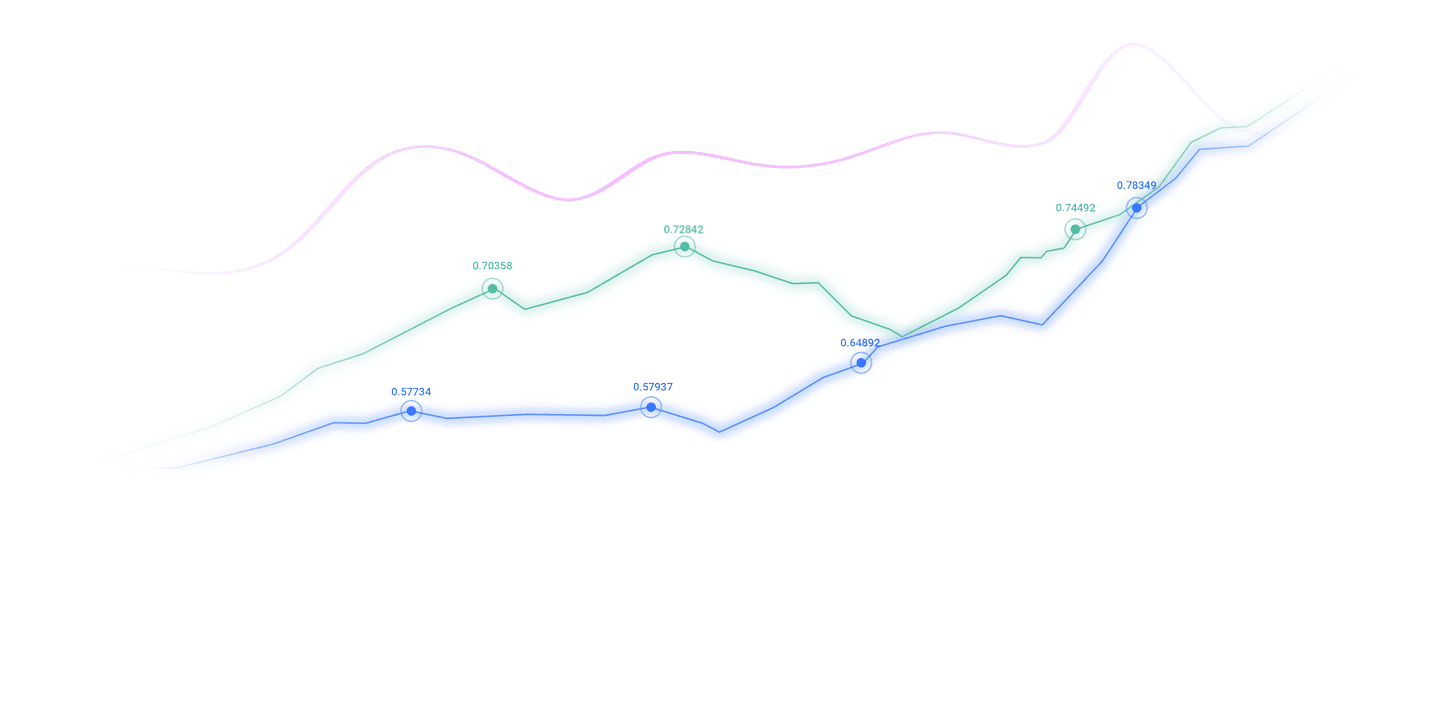

Gold news analysis: On Tuesday (November 4), spot gold bottomed out and rebounded during the U.S. trading session. Gold returned to Monday's negative low for gold and last Friday's low. It is currently down 0.94% and trading around $3,963. The recent U.S. threats to Venezuela and Nigeria have revived market risk sentiment and boosted demand for safe havens. Gold has attracted some low-price bargaining funds to intervene. At the same time, the long-term shutdown of the U.S. government has further provided support for gold. However, the Fed's hawkish tendencies are good for U.S. dollar bulls, and may clearly suppress the gains of gold, which has no return attributes. At the same time, the Fed's hawkish tendencies may limit the sharp correction of the U.S. dollar, which will suppress gold, which has no return attributes. In addition, the recent trend of gold has been range-bound in the chosen direction, so recent additional information will have a direct response to the price of gold. Spot gold is generally viewed as a safe-haven asset that is inversely correlated with the U.S. dollar and U.S. Treasury yields. However, in this round of market conditions, its performance is more www.xmaccount.complex, reflecting both the driving force of risk aversion and theSuppressed by the strength of the U.S. dollar.

Gold technical analysis: Gold's shock rebound this week was hindered by the current decline and breaking through this week's new low. Recently, we have repeatedly emphasized that the idea of shoring on the rebound remains unchanged. I believe friends who follow me can see that the short trend of gold has not changed for the time being. We can intervene in short orders when the rebound is under pressure. Judging from the 4-hour market trend, the top is currently focusing on the short-term suppression of the 4000 line position. This is also the key pressure zone where multiple rebounds on Tuesday failed to effectively hold, so the key to the strength of the market outlook is this. Position gains and losses, but it is too early to say that the market is extremely weak, because as you can see in the near future, the market is still running repeatedly within the range. It is currently weak and oscillating, and the strong support positions below are respectively 3915 and 3885. These two positions are not broken. It is expected that there will not be much space below, so if it falls above these two positions in the short term, it is still necessary to participate in a long order. As for the short position, it is relatively clear at the moment. With 4000 as the pressure position, you can make effective short orders on the rallies below, and make other plans after the position is broken. On the whole, today's short-term operation of gold, He Bosheng recommends to focus on rebounding from high altitudes, supplemented by falling back to lows. The top short-term focus will be on the first-line resistance of 3070-4000, and the bottom short-term will focus on the first-line support of 3910-3880.

Analysis of the latest crude oil market trend:

Crude oil news analysis: West Texas Intermediate crude oil (WTI) fell slightly by about 0.1% during the Asian session on Tuesday, trading around $61/barrel. OPEC and its partner organizations announced on Sunday that they would suspend plans to increase production starting in the first quarter of 2026, citing an expected seasonal slowdown in oil demand by then. The decision www.xmaccount.comes amid widespread market forecasts for a supply glut next year, which could further depress oil prices. In the past three months, WTI prices have fallen by about 9%. Analysts pointed out that this is mainly due to the fact that OPEC+ has accelerated the recovery of production in order to regain market share. At the same time, the United States and other non-OPEC oil-producing countries are also increasing production. Nonetheless, the strengthening of U.S. sanctions on two major Russian oil www.xmaccount.companies has once again cast uncertainty on the supply outlook in the short term.

Crude oil technical analysis: Looking at the daily chart of crude oil, the oil price touched the K line near 56 and closed three positive lines in a row, reducing the early downward decline. Oil prices cross the moving average system up and down, and the mid-term objective trend enters a volatile pattern. The MACD indicator opens upward below the zero axis, indicating that short momentum has weakened. It is expected that the trend of crude oil will pick up in the medium term, and the overall trend will mainly maintain a range-bound oscillation rhythm. The short-term (1H) crude oil trend has poor continuity in its upward trend and has once again formed a range-bound oscillation rhythm. Oil prices have repeatedly crossed the moving average system, and the short-term objective trend direction has been running sideways and oscillating. From a primary and secondary perspective, the overall trend is secondary consolidation. Referring to the primary and secondary alternation rules, it is expected that the trend of crude oil will still rise with a high probability during the day. On the whole, today's crude oil operation thinking is based on He Bosheng's suggestion to rebound low and long, supplemented by rebounding high. The top short-term focus is on the 61.5-62.5 first-line resistance, and the bottom short-term focus is on the 59.0-58.0 first-line support.

This article is exclusively planned by He Bosheng, a gold and crude oil analyst. Due to the delay in network push, the above content is personal advice. Due to the timeliness of online publishing, the suggestions in the article are for learning reference only, and you should operate at your own risk. Regardless of whether the views and strategies of the article agree with others, you can www.xmaccount.come to me to discuss and learn together! Nothing is difficult in the world, as long as there are people who are willing. Investment itself carries risks. I remind everyone to look for authoritative platforms and powerful teachers. Fund safety www.xmaccount.comes first, secondly consider operational risks, and finally how to make profits.

The above content is all about "[XM Foreign Exchange Platform]: 11.5 Gold Crude Oil Shock and Fall Latest Market Trend Analysis and Today's Exclusive Operation Suggestions". It is carefully www.xmaccount.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Sharing is as simple as a gust of wind can bring refreshing, as pure as a flower can bring fragrance. Gradually my dusty heart opened up, and I understood that sharing is actually as simple as the technology.

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here