Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

market news

Gold, the adjustment is not over yet!

Wonderful introduction:

Let me worry about the endless thoughts, tossing and turning, looking at the moon. The full moon hangs high, scattering bright lights all over the ground. www.xmaccount.come to think of it, the bright moon will be ruthless, thousands of years of wind and frost will be gone, and passion will grow old easily. If you have love, you should grow old with the wind. Knowing that the moon is ruthless, why do you always place your love on the bright moon?

Hello everyone, today XM Foreign Exchange will bring you "[XM Official Website]: Gold, the adjustment is not over yet!". Hope this helps you! The original content is as follows:

When I woke up, there was another "earthquake" in the financial market. The pie returned to the beginning of 9, and 470,000 people were forced to close their positions, the largest single-day drop since August.

U.S. stocks could not escape bad luck. Nvidia’s market value evaporated by 1.4 trillion overnight, and gold also fell to $30,930. www.xmaccount.compared with the currency circle and U.S. stocks, gold was relatively strong, and assets voted with their feet to buy gold as a safe haven.

November is destined to be a restless month. Domestic physical gold sales are taxed, bank gold deposits are prohibited from withdrawing physical gold, bulls in the external currency circle have suffered a bloodbath, and funds have been withdrawn from the stock market.

What are big capital panicking about?

The current tax on gold and the suspension of physical gold withdrawals by banks indicate that physical gold is now in short supply and there is simply not that much gold in the market, which means there is a price but no market.

It's like going to a bar and storing the endless wine. The wine list is getting larger and larger. Suddenly one day when the guests want to pick up the stored wine, the bar is out of wine.

Some time ago, silver experienced a liquidity crisis. Some brokerages directly banned the opening of silver positions, and a large number of orders were unable to obtain spot. Gold is very likely to face the same problem.

The order volume of domestic accumulated gold gold is a gathering place for retail investors or novice investors. In the past two years, banks have been the first choice to play gold. This is due to the natural trust in the safety of banks, coupled with the lack of leverage and the convenience of transactions such as accumulated gold.

As the price of gold rises higher and higher, retail investors begin to withdraw physical gold. No matter what method of online transactions, physical gold is not as safe for ordinary people. More and more people withdraw funds. Once a silver liquidity crisis occurs, the consequences of idling funds will be very serious.

Buying and selling, selling and buying are normal financial behaviors, only buying is notSelling, just like house prices, after they have reached sky-high prices, once a reverse cycle forms, it will be too late to put the brakes on.

The "reflexivity" emphasized by Soros is enough to explain everything. Divided into "forward circulation" and "counter-circulation".

Positive cycle: a self-reinforcing stop-and-go cycle. For example, gold: Due to geopolitical risks in the initial stage, a very small number of people believed that gold would appreciate in value. Then based on this understanding, the number of people buying it continued to increase. After that, the price of gold rose, and those who bought it in the future made money.

At this time, the reality of "gold price rising + someone making money" has verified the perception that "gold price will rise", attracting more people to believe that "gold will rise again", and more people will continue to buy, and the price will further skyrocket.

As a result, cognition and price push each other up, constantly verifying each other, reinforcing that gold will continue to rise, and you will make money as long as you hold it. It gradually loses touch with the intrinsic value of its own assets, which is the "bubble" period.

Counter cycle: When the price far exceeds the intrinsic value of the asset itself, or there is a reality that funds or policy expectations cannot support "continue to rise", a few people's perception begins to waver, and some people choose to profit and exit. When the price falls excessively (oversold), the price decline and losses expand. The more people choose to leave the market, the more they fall, the more they sell, and the more they sell, the more they fall. The reality in turn strengthens their cognition.

In a word: rising is the mutual reinforcement between cognition and reality (price), while falling is the two-way negative reinforcement between cognition and reality (price). What the policy is worried about is the emergence of negative reinforcement, which may not happen in the short term, but will it happen in the next 1-2 years? Plan ahead.

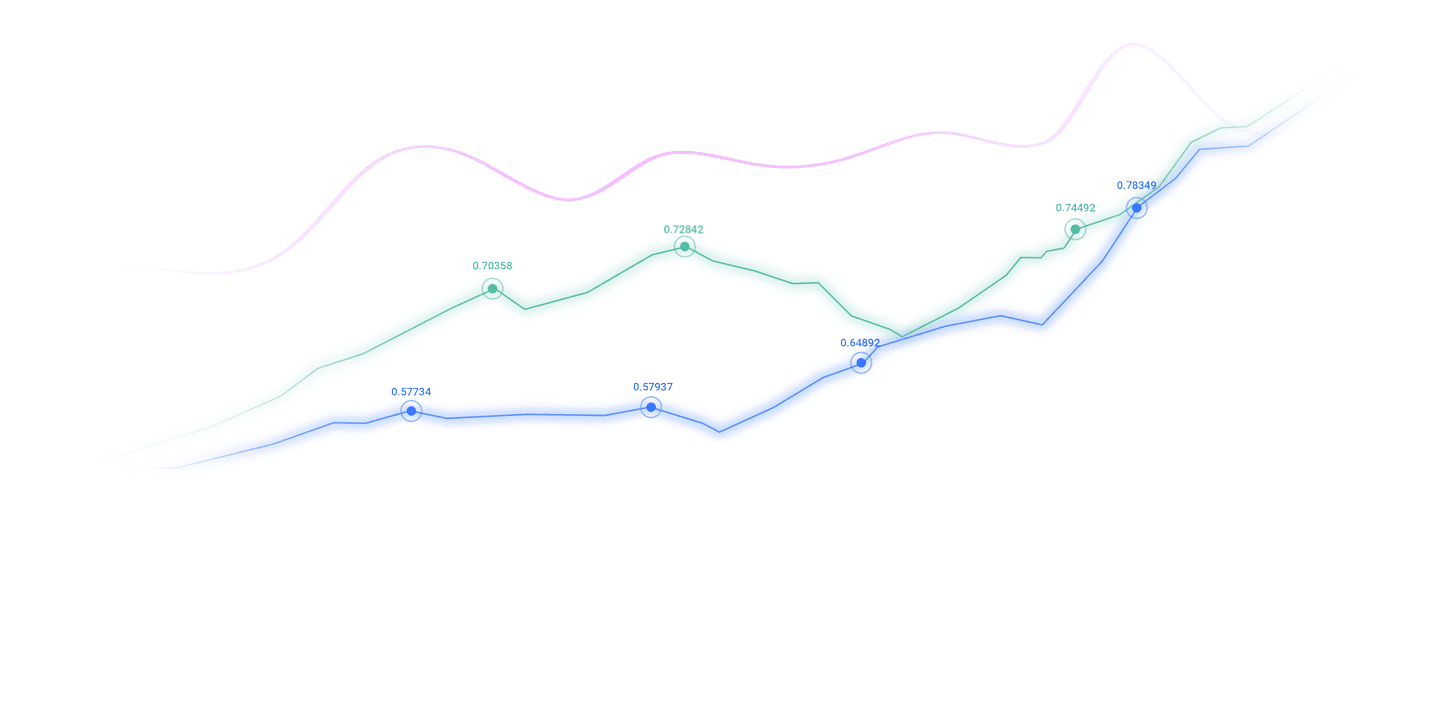

The short-term adjustment for gold has not changed. This view has repeatedly emphasized the importance of US$4,050 in the past few days. "Gold, US$4,050 determines the rise and fall!" "The article pointed out that the rebound around 4020 is still dominated by callbacks, with the highs moving downwards and the lows breaking. Once the 3900-3880 US dollars are broken, many people who entered the market anxiously in the early stage will be stopped and left, intensifying the downward trend.

In addition, don’t rush to pursue a weak decline. Open a position when you are given a chance. If you are not given a chance, wait. The U.S. government has not yet opened its doors. Whether Friday’s non-farm payrolls will be announced as scheduled, the number of people filing for unemployment benefits next week, and ADP employment data will all affect the direction of gold.

Today, my view remains unchanged. The pressure after the rebound is in the range of 3970-4000 US dollars. Find a short position in this range. There is no right or wrong in the long and short positions in the volatile market. Maybe someone is right to grab the long position. I still pay attention to the gains and losses of 3930-3900 US dollars.

The above content is all about "[XM Official Website]: Gold, the adjustment is not over yet!" It was carefully www.xmaccount.compiled and edited by the XM foreign exchange editor. I hope it will be helpful to your trading! Thanks for the support!

Only the strong know how to fight; the weak are not even qualified to fail, but are born to be conquered. Hurry up and study the next content!

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here