Trusted by over 15 Million Traders

The Most Awarded Broker

for a Reason

CATEGORIES

News

- The US dollar stabilizes above the 98 mark, and the news of miserable tariffs tr

- Gold, new highs continue to be bullish!

- The darkest moment in the euro zone!市场做空欧元,押注历史性崩盘

- Gold fell as expected in the US session at 3338, and continued to be short in th

- A collection of positive and negative news that affects the foreign exchange mar

market news

The U.S. labor market showed signs of stability in October, and gold briefly returned to $3,990

Wonderful introduction:

The moon waxes and wanes, people have joys and sorrows, life changes, and the year has four seasons. If you survive the long night, you can see the dawn, if you endure the pain, you can have happiness, if you endure the cold winter, you no longer need to hibernate, and after the cold plums have fallen, you can look forward to the new year.

Hello everyone, today XM Forex will bring you "[XM Group]: The U.S. labor market showed signs of stability in October, and gold once returned to $3,990." Hope this helps you! The original content is as follows:

On November 6, in early trading in Asia on Thursday, Beijing time, the U.S. dollar index was hovering around 100.07. On Wednesday, as economic data eased concerns about the U.S. economy and labor market, prompting investors to weigh the possibility of another interest rate cut by the Federal Reserve this year, the U.S. dollar index fluctuated above the 100 mark and finally closed down 0.06% at 100.12. The benchmark 10-year U.S. Treasury yield finally closed at 4.160%, and the 2-year U.S. Treasury yield, which is sensitive to the Fed's policy rate, closed at 3.638%. Although the U.S. private employment data was stronger than expected, investors still sought safety. Spot gold rose by more than 1% during the day, and once returned to above the $3,990 mark, but failed to stabilize here, and finally closed up 1.19%, closing at $3,979.05 per ounce; spot silver finally closed up 1.81%, at $48.00 per ounce. As the market worried about oversupply, crude oil continued to fall. WTI crude oil fluctuated downward during the day, and accelerated its decline during the U.S. trading session, finally closing down 1.28% at US$59.48/barrel; Brent crude oil finally closed down 1.27% at US$63.32/barrel.

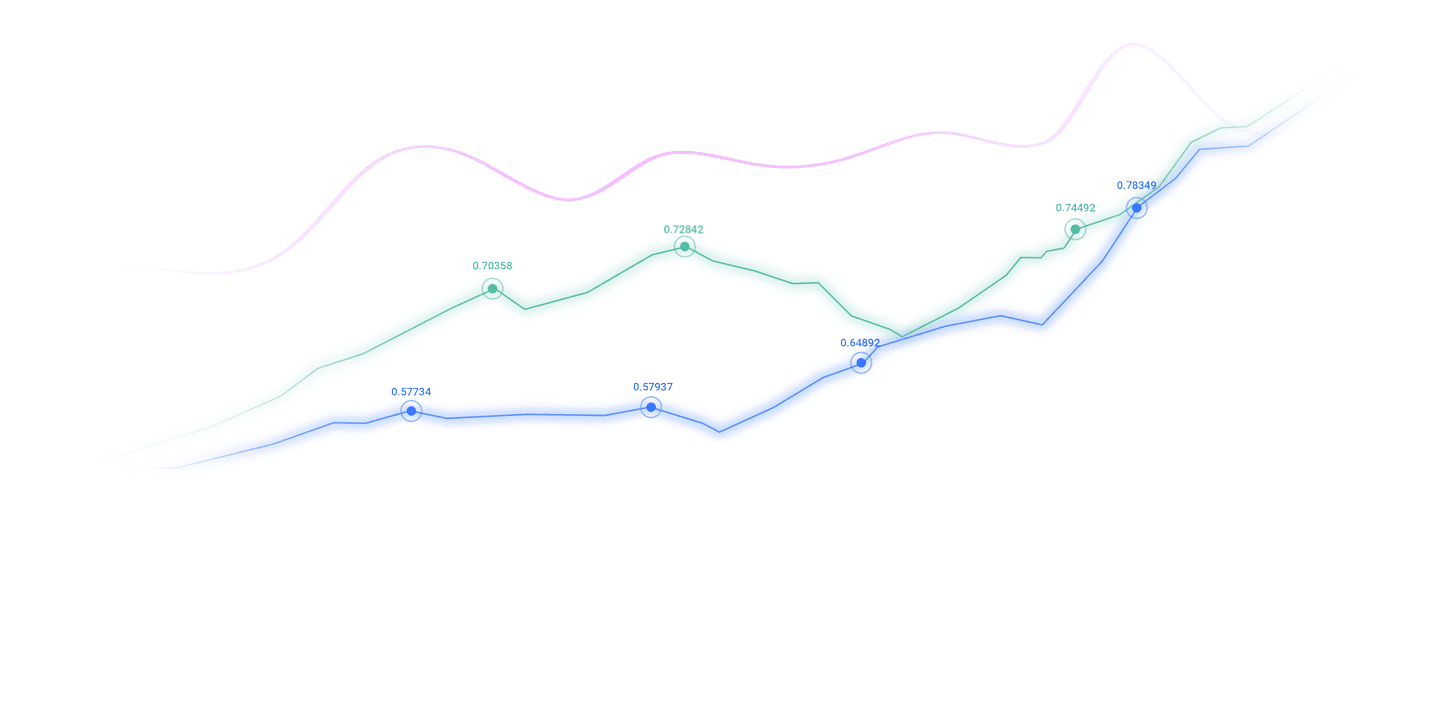

Analysis of major currency trends

U.S. dollar index: As of press time, the U.S. dollar is hovering around 100.07. The dollar currently has solid support: solid non-manufacturing demand, rising yields and cautious expectations for the Federal Reserve. Technically, if the USD Index manages to close above the resistance at 100.00–100.15, it will move towards the next resistance at 101.85–102.00.

Analysis of gold and crude oil market trends

1) Analysis of gold market trends

In the Asian session on Thursday, gold hovered around 3970.97. In the short term, the pressure on the US dollar's 200-day moving average and the rise in US bond yields will create fluctuations in gold prices; but in the medium term. Look, there is no solution to the government shutdown + the Supreme Court's "tariff death penalty" is pending. As long as these two thunderbolts are not removed, safe-haven funds will continue to pour into gold this trading day. We need to continue to pay attention to the speeches of Federal Reserve officials and pay attention to the number of layoffs of challenger www.xmaccount.companies in the United States in October and the Bank of England interest rate decision.

2) Crude oil market trend analysis

On Thursday’s Asian session, crude oil was trading around 59.48. West Texas Intermediate (WTI) crude extended losses for a third straight day on Wednesday, falling below the key $60.00 per barrel mark and hitting a one-week low after the latest report from the U.S. Energy Information Administration (EIA) showed a larger-than-expected build in inventories.

Foreign exchange market transaction reminder on November 6, 2025

Pending Tesla’s annual shareholders’ meeting

15:00 Germany’s monthly seasonally adjusted industrial output rate in September

16:00 Switzerland’s seasonally adjusted unemployment rate in October

18: 00 Eurozone monthly retail sales rate in September

20:00 The Bank of England announces the interest rate decision

20:30 The number of layoffs at challenger www.xmaccount.companies in the United States in October

21:30 The number of initial jobless claims in the United States in the week to November 1

23:00 United States 1 Global Supply Chain Stress Index in October

23:00 US monthly wholesale sales rate in September

23:30 EIA natural gas inventories in the US for the week to October 31

The next day at 00:00 Fed Williams gave a speech

The next day at 00:00 US Federal Reserve Federal Reserve Board Governor Barr participated in an online discussion

The next day at 01:00 Fed Hammaker gave a speech

The next day at 04:30 Federal Reserve Board Governor Waller participated in a panel discussion

The next day at 05:30 Federal Reserve Board Paulson gave a speech

The above content is about "[XM Group】: The U.S. labor market showed signs of stability in October, and gold once returned to $3,990. The entire content was carefully www.xmaccount.compiled and edited by the editor of XM Foreign Exchange. I hope it will be helpful to your trading! Thanks for the support!

Due to the author's limited ability and time constraints, some contents in the article still need to be discussed and studied in depth. Therefore, in the future, the author will conduct extended research and discussion on the following issues:

Disclaimers: XM Group only provides execution services and access permissions for online trading platforms, and allows individuals to view and/or use the website or the content provided on the website, but has no intention of making any changes or extensions, nor will it change or extend its services and access permissions. All access and usage permissions will be subject to the following terms and conditions: (i) Terms and conditions; (ii) Risk warning; And (iii) a complete disclaimer. Please note that all information provided on the website is for general informational purposes only. In addition, the content of all XM online trading platforms does not constitute, and cannot be used for any unauthorized financial market trading invitations and/or invitations. Financial market transactions pose significant risks to your investment capital.

All materials published on online trading platforms are only intended for educational/informational purposes and do not include or should be considered for financial, investment tax, or trading related consulting and advice, or transaction price records, or any financial product or non invitation related trading offers or invitations.

All content provided by XM and third-party suppliers on this website, including opinions, news, research, analysis, prices, other information, and third-party website links, remains unchanged and is provided as general market commentary rather than investment advice. All materials published on online trading platforms are only for educational/informational purposes and do not include or should be considered as applicable to financial, investment tax, or trading related advice and recommendations, or transaction price records, or any financial product or non invitation related financial offers or invitations. Please ensure that you have read and fully understood the information on XM's non independent investment research tips and risk warnings. For more details, please click here